Business

Immediate Deduction of Capital Purchases Extension

Temporary full expensing will be extended by 12 months to allow eligible businesses* to deduct the full cost of eligible depreciable assets of any value, acquired from 7:30pm AEDT on 6 October 2020 and first used or installed ready for use by 30 June 2023.

Temporary loss carry-back extension

The loss carry-back measure will be extended to allow eligible companies* to carry back (utilise) tax losses from the 2023 income year to offset previously taxed profits as far back as the 2019 income year when they lodge their tax return for the 2023 income year

* aggregated turnover of less than $5 billion

Digital economy strategy

The Government will provide $1.2 billion over six years from 2022 for the Digital Economy Strategy, to support Australia to be a leading digital economy and society by 2030.

From an income tax, investment incentive perspective, please contact us for more information

Superannuation

Removing the work test for voluntary will allow individuals aged 67 to 74 years (inclusive) to make or receive non-concessional contributions (including under the bring-forward rule) and salary sacrifice contributions without meeting the work test, subject to existing contribution caps.

Individuals aged 67 to 74 years (inclusive) will still have to meet the work test to make personal deductible contributions.

Removing the $450 per month threshold for Superannuation Guarantee (‘SG’) eligibility

The Government will remove the current $450 per month minimum income threshold, under which employees do not have to be paid SG contributions by their employer. The measure will commence from 1 July 2022.

Downsizing Contributions

The downsizer contribution allows eligible individuals to make a one-off, after-tax contribution to their superannuation fund, of up to $300,000 per person, following the disposal of an eligible dwelling, where certain conditions are satisfied. Under the current requirements, an individual must be at least 65 years of age at the time of making the relevant contribution, for the contribution to qualify as a downsizer contribution. From 1 July 2022, the age limit will decrease to 60 years of age.

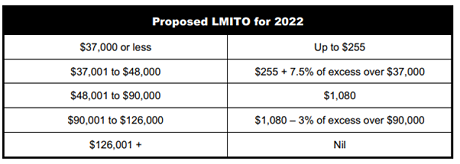

Retaining the Low and Middle Income Tax Offset (‘LMITO’) for the 2022 income year

The Government has announced that it will retain the LMITO for one more income year so that it will still be available for the 2022 income year. Under current legislation, the LMITO was due to be removed from 1 July 2021.

Increasing the Medicare levy low-income thresholds The Government will increase the Medicare levy low-income thresholds for singles, families and seniors and pensioners for the 2021 income year, as follows:

• The threshold for singles will be increased from $22,801 to $23,226.

• The family threshold will be increased from $38,474 to $39,167.

Reducing compliance costs for individuals claiming self-education expense deductions

The Government will remove the exclusion of the first $250 of deductions for prescribed courses of education. Currently, the first $250 of a prescribed course of education expense is not tax deductible. Removing this $250 exclusion is expected to reduce compliance costs for individuals claiming self-education expense deductions. This will commence from July 2022.

Your Accounting Partner

Your Accounting Partner Your Management Accounting Partner

Your Management Accounting Partner Your Expansion Engineer

Your Expansion Engineer Your Special Projects Partner

Your Special Projects Partner