Although not announced as part of this year’s Federal Budget, it’s important for employers to note that the superannuation guarantee (SG) rate will increase from the current 10.5% to 11% on 1 July 2023.

Employers will need to remember to update your payroll system to comply with this increase. The new SG rate applies to payments made to workers on or after 1 July 2023.

Super guarantee percentage

PERIOD GENERAL SUPER GUARANTEE (%)

|

1 July 2022 – 30 June 2023 |

10.5% |

|

1 July 2023 – 30 June 2024 |

11% |

|

1 July 2024 – 30 June 2025 |

11.5% |

|

1 July 2025 – 30 June 2026 |

12% |

- Details can be found on the Australian Taxation Office website.

- Contact Blackburn Accounting if you need help or advice with this or other accounting matters.

Read more...

Calculate Co-Contributions

Check your eligibility for the co-contribution, it's a good way to boost your super. The amounts differ based on your income and personal super contributions.

If you are able to pay a little extra into your super before the end of the financial year 2024, the government may also make a contribution. Known as a co-contribution, you could receive up to a maximum of $500 contribution from the government into your super account if you are eligible.

Under the co-contribution scheme, the government provides a tax-free superannuation contribution of up to $500, matching 50% of a contributor’s own contributions.

|

Year |

Lower |

Upper |

|

2023-24 |

$43,445 |

$58,445 |

Superannuation What to Know

Superannuation has many facets, what to know, what is required, and what to do. To get the best outcomes speak with a professional about the strategies best suited to your situation.

If you are a Business owner Blackburn Accounting is available to provide professional advice. We offer a broad range of services including personal, Family Business Management, Cashflow Management, Superannuation and retirement planning, and Business Development.

Worth thinking about.

Consider splitting contributions with your spouse if:

- your family has one main income earner with a substantially higher balance or

- if there is an age difference where you can get funds into pension phase earlier or

- if you can improve your eligibility for concession cards or age pension by retaining funds in superannuation in the younger spouse’s name.

- remember any spouse contribution is counted towards your spouse's Non-Concession Contribution cap.

Want to know more, have questions!

Contact us, Blackburn Accounting, we are available and ready to help you with all your taxation and accounting needs.

Read more...

Boost your spouse's super and reduce your tax by making spouse contributions.

Tell me more!

How Does it work?

If you make an after-tax super contribution into your spouse’s super, you may be eligible for a tax offset of up to $540.

Consider this strategy if;

- Your spouse has an assessable income of less than $40,000 p.a.

What are the benefits?

- Grow your spouse's super

- Qualify for a tax offset of up to $540.

How is the spouse offset calculated?

- To qualify for the full offset of $540 in 2023/24 you need to contribute $3,000 or more into your spouse’s super. Your spouse must earn $37,000 p.a. or less.

- A lower tax offset may be available if you contribute less than $3,000 or your spouse earns more than $37,000 p.a. but less than $40,000 p.a.

Example Case study:

Bill and Mary are married and have two young children. Bill works full-time, earning $100,000 a year. Mary has reduced her workload and is now working two days a week and earns $32,000 a year.

The couple want to make sure Mary keeps growing her super while she is working part-time. Bill contributes $3,000 into Mary's super account. This entitles him to a tax offset of $540 which will reduce his income tax when he completes his 2023/24 tax return.

There are important things to consider when exploring the above and eligibility conditions apply. For more information check the ATO website

Need help, have questions and want answers and solutions?

Contact Blackburn Accounting we are your family Business Specialists offering a range of services including Superannuation and Retirement Planning.

Read more...

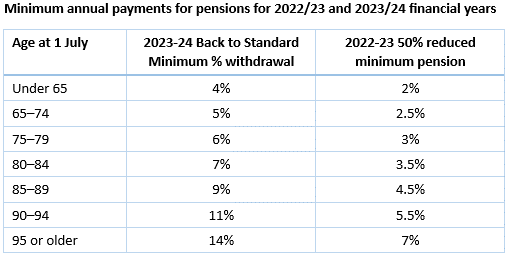

Review Options on Pension Payments

The Government extended the Temporary Reduction in Minimum Pensions as part of the COVID-19 response for FY2023. This program has now finished and the minimum pension payments have reverted back to the normal rates from 1 July 2023.

Superannuation has many facets. To get the best outcomes speak with a professional about the strategies best suited to your situation.

If you are a Business owner Blackburn Accounting is available to provide professional advice. We offer a broad range of services including personal, Family Business Management, Cashflow Management, Superannuation & Retirement planning, and Business Development.

Superannuation updates - Check the ATO website for more information.

Read more...

Your Accounting Partner

Your Accounting Partner Your Management Accounting Partner

Your Management Accounting Partner Your Expansion Engineer

Your Expansion Engineer Your Special Projects Partner

Your Special Projects Partner