Most Small Businesses will experience ‘cashflow challenges’ those times when the sea of money seems to be adrift, with more money going out of the Business than there is cash coming in!

If this sounds familiar you are not alone with ‘92% of Australian small Businesses experiencing negative cashflow with owners struggling to pay essential costs such as rent and wages’ (Insight report July 2022). This is financial pressure small Business doesn’t need!

The good news is that there are ways to help stay afloat! With foresight and adopting sound financial management strategies some common mistakes can be avoided and obstacles overcome.

Here are some common challenges with our Top Tips to help you overcome them!

- Profit margins: Particularly relevant in the current inflationary spiraling pricing cycle, it’s critical to have true-cost pricing. Don’t let your profit margins be eaten away by increasing costs.

Tip: Regularly check the cost of goods and products and determine realistic profit margins by setting prices not too low or too high. Pricing points are needed to keep you competitive and in the red. Offer value for money and your customers will keep coming back!

- Overdue payments: monies due to you: Slow and late payments pose the greatest risk to small Business. Cash in keeps the money flow flowing, without it the cash river dries up!

Tip: Have an efficient invoicing and billing system in place, one that generates accounts at point of sale and offers various payment methods. Electronic systems can also monitor receipts and overdue accounts allowing you to better manage and avoid late payments. Keep on top of your debtors ledger, remember you are running a Business.

- Personal and Business financial matters: Mixing money, personal and Company transactions is fraught with danger, including relationship friction and can easily lead to ‘robbing Peter to pay Paul’!

Tip: Keep separate systems and records and avoid ‘borrowing’ from either. Makes it simpler for all concerned including for providing true and accurate Business financial reports, taxes and audits.

Read more...

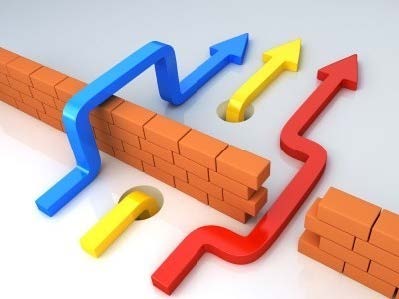

In your way, there they are Roadblocks, barriers and obstructions, holding you back, stopping you from achieving the success you and your Business deserve!

You may be feeling such obstacles are insurmountable and too difficult to deal with. You are daunted, overwhelmed and even exhausted trying to find answers!

But don’t give up, there are strategies you can adopt to overcome them. You can achieve the success you deserve!

READ on, to learn how you can bypass Roadblocks to achieve your Business Success.

Let’s get started by looking at some possible Roadblocks

- Cashflow challenges

- Under utilising resources

- Lack of confidence

- No Marketing Plan

- Poor Customer Service

- Time

Are these familiar to you?

Yes! Check these 6 Tips 'how to get around them'.

1. Cashflow Challenges:

A barrier for many small Businesses, you find you are robbing Peter to pay Paul, and with no Financial Plan or Strategy you are operating on the edge. Stressful and often nail-biting times.

To overcome this barrier

Simply put, ‘good supplier and customer management will ensure you have a consistent flow of money coming in from sales to be able to pay your bills’. And don’t we all want that?

There are ‘9 Ways to Help get your Cash Flow flowing’! Click on the link......... https://blackburnaccounting.com.au/blog.

2. Under utilising Resources:

This can be both human resources and equipment that are available but not fully utilised or employed efficiently to maximum capacity and capability. Employees lacking training, or without empowerment are wasted resources. Equipment may be in need of upgrade or repair. In this situation, productivity is compromised.

To remove this obstacle

Read more...

Success can be different for everyone, fame, fortune, happiness! All of those and more!

How you define it will vary as will the factors shaping it. It can look, feel and be different for us all!

If you are a Business owner it also depends on your lifestyle, goals and aspirations and what you hope to achieve with your small Business, now and long term.

When you consider all these factors and influences, and which are the most important, you might see Success as providing benefits.

The 6 Benefits of Success

- Improve Cashflow

- Reduce risk

- Have clear direction

- Take action

- Develop a winning Team

- Having fun

Success looks like, feels like:

- achieving specific measurable goals and objectives,

- overall satisfaction, belief in self and Team

- being emotionally and financially stable, peace of mind

- doing what you love and enjoying your work everyday

- reward with profit for hard work

- making a difference, with personal effort, quality products and service.

Let's look more closely at the 6 Benefits of Business Success:

1. Improve cashflow:

A regular and smooth flow of money in and out of the Business necessary for daily operations, and costs including paying employee's, purchasing stock, and taxes. Positive cashflow indicate the Business liquidity.

There are 9 Ways to Help get your Cash flowing. Click on link.....https://blackburnaccounting.com.au/blog

2. Reduce Risk: Risk comes in different ways requiring different strategies to manage.

Read more...

Your Accounting Partner

Your Accounting Partner Your Management Accounting Partner

Your Management Accounting Partner Your Expansion Engineer

Your Expansion Engineer Your Special Projects Partner

Your Special Projects Partner