This time last year we covered the burning issues of cost-living-pressures, high inflation and consumer confidence!

12 months on, here we are still battling and countering the effects of price increases that are impacting our lives. Discretionary spending now is the way forward for many. This habit is reflected in a recent headline, 'cost of living bites down on West Australians' with comments 'the community is broadly attempting to rein in spending, or at least choosing where to spend their money' (West Newspaper). Yes, whether consumers or small Business operators, no one can escape these pressures.

What's changed?

The good news is our inflation has been coming down, a sign that tighter financial conditions have dampened upward pressure. But be aware of the Reserve Bank's position, announcing it is ready to act as needed. Increase or decrease, it's a wait and see, a situation keeping many on edge. Not so happy are mortgage holders arguing they are still hurting by the increased interest rates and struggling with everyday expenses.

For others, although household budgets are under pressure, and some travel plans are on hold, many are still willing to enjoy their treats, taking staycations, Gym memberships, grabbing that morning takeaway coffee and dining out. Smashed avocado is still on the menu! and entertainment, live concerts are also popular. The summer holiday break and new years resolutions seen as driving this spending.

This trend supports the more resilient industries, hospitality, beauty and fitness. These Business in return provide employment opportunities for a mostly casual workforce, with many of these taking on more than one job to ease household pressures. This now described as the 'poly-employment' trend.

Other good news!

Read more...

Rituals have been part of civilization for thousands of years with social rituals providing emotional comfort and belonging, group cohesion and to practice solidarity. Simply said, they shape and bind a society together.

This evolves by combining a sequence of 'ritual' activities involving words, gestures, actions and sometimes revered objects. Their purpose is varied and can include strengthening social bonds, supporting the emotional needs of followers or fulfilment of religious ideals or obligations.

Rituals do matter!

They influence our behaviours playing a part in our everyday lives, by providing purpose, direction and connection.

Just think about it! Most of us are creatures of habits, with regular rituals. For some, its a morning coffee and reading the paper, while others, such as sport stars, have rituals, routines and habits on game day to help them prepare. Births, Weddings, Funerals, Festivals and seasonal ceremonies are examples of social rituals we observe.

It's no different in the Workplace there are existing rituals but there is the scope to create new ones!

- A workplace is described as a community of people working towards a common goal, and like other communities uses rituals to help build rapport, stay aligned, and improve motivation.

- Workplace rituals designed to increase employee engagement when followed by the team have the power to influence and positively impact outcomes. Rituals boost company culture as they make employees feel more connected to their colleagues and the organization.

What are Workplace Rituals and Why do they Matter – The Benefits!

Workplace rituals include:

- gatherings, like Team Meetings

- award presentations

- Leadership Workshops

- birthday milestones

- ‘set’ Staff Friday lunch dates

Rituals matter because they can:

- shape, define and build company culture

- help during times of change and uncertainty

- boost focus and increase creativity

- help recognise your Team

- motivate and unite Teams to excel

- provide opportunities to come together

The Benefits:

- allow us to network

- interact with our peers

- share experiences

- build connections and relationships.

- to be part of and engage in a special occasion.

- foster organisational positive behaviours and citizenship

Rituals have the power to positively impact the Workplace by:

Read more...

In your way, there they are Roadblocks, barriers and obstructions, holding you back, stopping you from achieving the success you and your Business deserve!

You may be feeling such obstacles are insurmountable and too difficult to deal with. You are daunted, overwhelmed and even exhausted trying to find answers!

But don’t give up, there are strategies you can adopt to overcome them. You can achieve the success you deserve!

READ on, to learn how you can bypass Roadblocks to achieve your Business Success.

Let’s get started by looking at some possible Roadblocks

- Cashflow challenges

- Under utilising resources

- Lack of confidence

- No Marketing Plan

- Poor Customer Service

- Time

Are these familiar to you?

Yes! Check these 6 Tips 'how to get around them'.

1. Cashflow Challenges:

A barrier for many small Businesses, you find you are robbing Peter to pay Paul, and with no Financial Plan or Strategy you are operating on the edge. Stressful and often nail-biting times.

To overcome this barrier

Simply put, ‘good supplier and customer management will ensure you have a consistent flow of money coming in from sales to be able to pay your bills’. And don’t we all want that?

There are ‘9 Ways to Help get your Cash Flow flowing’! Click on the link......... https://blackburnaccounting.com.au/blog.

2. Under utilising Resources:

This can be both human resources and equipment that are available but not fully utilised or employed efficiently to maximum capacity and capability. Employees lacking training, or without empowerment are wasted resources. Equipment may be in need of upgrade or repair. In this situation, productivity is compromised.

To remove this obstacle

Read more...

What are Routines and How Can They Benefit You

Routines are a sequence of actions that we do repeatedly. A series of activities performed regularly at a particular time, in a particular way.

Simply, a routine is a set of activities, actions and behaviours when implemented help shape, balance and maintain our lifestyle.

Examples are everyday activities, such as brushing our teeth, doing a daily morning run, or following office procedures.

A routine can be repeated as frequently as needed, daily, monthly, with the aim of helping us be more productive, organized and focused.

A daily work routine is a set of behaviours and actions aimed at accomplishing tasks in the most efficient way when undertaken regularly. The weekly shopping, taking the dog for a daily walk, or monthly Team Reporting Meeting, it’s about getting things done in an orderly and efficient way!

The Benefits of Effective Routines include:

- providing structure in our daily activities that can help in reducing stress, lack of concentration and anxiety.

- can help in times of uncertainty and unpredictability by giving us direction and meaning.

- helps reduce the need to plan on a daily basis by taking the guesswork out of what is needed to be done. Read more...

Something we have all heard, said or hoped for!

Running a Business like Clockwork, when the ‘business operates without problems or delays, or happens regularly.’ To manage, run something efficiently, in a reliable matter.’ You could say the ‘cogs’, the wheels and the functions of the Business are well-oiled, finely tuned and operating and running smoothly. Like a quality clock or watch!

Let's begin by asking the burning question! How well is your Business operating?

When we examine this, there are many moving parts that make up a Business. We need to be aware of all elements of your Business, like cogs that make up a watch or clock.

- How well is your Business operating?

- What cogs function well?

- What others need work?

The Key to Success is to design your Business to run itself! …..like Clockwork!

When your Business runs like clockwork it will flourish and grow, and so will you!

Impossible! It’s POSSIBLE, READ on.....

Start by tracking how your Business currently runs. Identify all the functions and actions, activities and decisions you and your Team make. What are the systems and processes? Simply put, find out what makes your Business run, ‘tick’ and chime! or breakdown!

Next, Read our 4 Tips to get your Business running smoothly like Clockwork.

- Plan for Success 2. Optimise Systems 3. Invest in Staff 4. Set the Standard

Unlocking Success – How to Get the Best Results for Your Business

And don’t we all want that!

If you’re not achieving the results you want our BBB is a must attend!

- Learn How to build a Better Business, YOUR Business

- Learn Strategies, Techniques and Tips to make your Business the success it and you deserve!

Take action today for a successful future, your future!

Session dates – ‘Setting the Stage for Success’

Wednesday 1st November 2023

5.30pm to 7.30pm

Venue 931 Albany Hwy East Victoria Park

Tuesday 7th November 2023

5.30pm to 7.30pm

Venue 931 Albany Hwy East Victoria Park

Friday 17th November 2023

9.30am to 11.30am Perth WA

ONLINE Zoom

Here is what you will learn from the Session:

- Understand the crucial elements to Realise a Better Business

- Identify the key roadblocks that are holding you back

- Develop clear direction and how to do it

1 day Workshop – ‘Unlocking Success – How to Get the Best Results for Your Business’

Friday 8th December 2023

10am to 3pm

Venue 931 Albany Hwy East Victoria Park

Here is what you will learn from the Workshop:

- Crafting a solid Business Strategy that drives results

- Defining target audience and tailoring your offerings to meet their needs

- Implementing effective Marketing Strategies to reach and engage Customers

- Engage in activities and receive valuable related material

To book your place, Click our link

https://workshop.blackburnaccounting.com.au/

Read more...

At our last Staff Christmas Party, it looks like Cinderalla has lost her shoe!! Have you experienced a memorable Staff Party recently?

At our last Staff Christmas Party, it looks like Cinderalla has lost her shoe!! Have you experienced a memorable Staff Party recently?

If you are an Employer as we embrace the fun festivities of Christmas celebrations are you ready, ready for what can be a very silly season for some.

8 Top Tips for Staff management during the ‘Silly' Season:

- Establish clear guidelines, codes of conduct, for what is acceptable and unacceptable behaviour in the workplace. Importantly ensure these are communicated directly to all employers so there is no misunderstanding or confusion about behaviour at both the workplace and work-related functions.

- HR Policies, Health & Safety. Now is a good to visit all your HR policies to ensure they are current. Update as needed and adopt and implement any gaps. For example, most of society are now engaged in social media activity that can come into the workplace. There needs to be a clear policy set around this.

- In advance, actively promote and communicate your HR policies to all employers, raising awareness of sick leave, drug and alcohol policies. Conduct Information sessions and refresher training courses.

- Social media policies need to be publicized. A reminder that ‘party-mood’ actions, comments, tweets and posts can be detrimental. What is thought funny by the ‘instigator’ may not be considered as such by those targeted. ‘Bad media’ can also reflect poorly on the organization.

- As an Employer support and join in the spirit of the Festive season. No-one likes a Christmas-gringe. Small things, such as decorations can add to the ‘spirit’.

- Lead by example. Set the standard with your own actions and behaviours. If organizing a function consider offering pre-paid taxi vouchers, have responsible drinking bar limits and adopt similar safety strategies.

- Understand not everyone celebrates Christmas and make sure those not joining in are not pressured by others to do so. Promote a workplace environment that is tolerant of all beliefs.

- Planning for leave. Support staff taking leave during this period as pre-organising can help with managing the workload and reduce ‘sickies’

Apply these simple strategies and you will help make this ‘silly’ season memorable for all the right reasons.

Read more...

If you are a Small Business most likely you are experiencing a change in consumer behaviour as cost-of-living pressures impact their spending habits.

As an operator you can't afford to ignore or wait! Now is the time to think, act and adapt to the situation. Human behaviour is ever changing just as too is the marketplace.

Key to your Business survival is understanding those behaviours and developing agile Business strategies to make you fit for purpose, for now and the future!

It’s understanding the changes and finding ways to respond to have, get and keep market share.

Tick-box Tips for Businesses How to Respond Effectively:

- Enhance Customer Communication and Engagement

- Rethink Pricing Strategies and Offerings

- Provide Value-added Services & Benefits

- Develop Your Team

- Explore Collaboration's and Relationships

- Embrace Technology

Enhance Customer Communication and Engagement: Put a face to your Business, share your Company’s story, vision, personalise interactions, and take a social but professional approach in your communications. Be active in the social media space, show, tell and sell your Business, the web is your oyster.

Rethink Pricing Strategies and Offerings: Importantly be prepared to explore the various pricing strategies (Cost-plus pricing; Competitor based pricing and Value-based pricing) and adopt what approach best suits your Business and situation. Asking customers and staff for feedback shouldn’t be overlooked they are at the forefront of your service.

Read more...

Recruiting staff has never been more challenging and on the other side of the pandemic smart small Businesses are doing it smarter by adopting a more strategic approach to this task. Rather than ad-hoc and piecemeal, the process is now more refined and organised. This framework has developed shaping the strategies for attracting and recruiting the best talent.

Recruitment Strategies for small Business include:

- Social media opportunities: Post on all platforms. Facebook, Instagram, LinkedIn, these are the super highways of communication. Put the word out you are hiring, looking for the ‘right’ people to join and help build your successful enterprise.

- Sell your Brand & Culture: in all mediums, promote, show and tell what your Business is all about. Be the messenger, the story teller sharing the values, vision and what makes it great place to work in. Your job descriptions should reflect this professional and positive culture, making it attractive to applicants.

Recognise Your Tipping Point and Take Action before it’s Too Late!

Read on for our 5 Action Strategies!

Tipping Point, Breaking Point or Boiling Point, terms most likely you have heard. Described by Cambridge Business English Dictionary as, ‘a time during an activity or process when an important decision has to be made or when a situation changes completely’.

This Tipping Point once reached can be the difference between success or failure. To go forward or stop! There is a reaction. One that takes you onto bigger or better things or is the opposite, the equilibrium unbalance causing you, the scales to topple over into a downslide or stagnation.

For Small Business: What does it Mean in Reality?

If you are a Small Business struggling with the current inflationary pressures you may be reaching your tipping point. For example, how to respond to spiraling costs of supplies, wages and overheads. At what point do you tip over the edge. Customers are becoming thriftier and more selective in their shopping habits, while still chasing value and quality.

In seeking solutions do you increase your prices and at what point will you tip the balance and lose customers. Alternatively, keep absorbing the costs, reducing and losing your profitability until closure.

Example:

Cafe 1, cup coffee $6 increases to $8 a 33% increase.

Cafe 2, same cup $6 increases to $6.50 (16% increase), with gradual increases over two rises. i.e.incremental increases to reach the tipping point.

Alternatively, a lump sum increase can the tip point and lose customers.

What is your breaking point?

What to do!

Take action by understanding what a Tipping Point is and how to identify it.

A Tipping point is the turning point at which a product, brand, or company becomes either highly successful or faces failure. The ‘scales’ will topple or tip over to positively or negatively! With the latter, reaching a Tipping point at which damage is irreversible or accelerating.

Better to see and heed the warning signs!

- Profit margins reducing

- Cashflow challenges

- Sales turndown

- Customer complaints

- Supply issues

5 Action Strategies:

- Identify the problem. Gather all relevant information. Avoid putting it off.

- Bring your Team together. Put the issue on the ‘table’ to brainstorm problems and seek solutions.

- Reach out to your Customers. Be upfront, connecting with honest and open communication. Don't apologise.

- Engage a Business professional advisor if needed.

- Speak with Blackburn Accounting let us help you get on top of your Business matters

Read more...

On 9 May 2023, as part of the 2023–24 Budget, the Australian Government announced it will improve cash flow and reduce compliance for small businesses by temporarily increasing the instant asset write-off threshold to $20,000, from 1 July 2023 until 30 June 2024.

This measure is not yet law.

Small Businesses, with aggregated turnover of less than $10 million, will be able to immediately deduct the full cost of eligible assets costing less than $20,000 that are first used or installed ready for use between 1 July 2023 and 30 June 2024.

The $20,000 threshold will apply on a per asset basis, so small businesses can instantly write off multiple assets.

Assets valued at $20,000 or more (which cannot be immediately deducted) can continue to be placed into the small business simplified depreciation pool and depreciated at 15% in the first income year and 30% each income year after that.

Read more...

Success can be different for everyone, fame, fortune, happiness! All of those and more!

How you define it will vary as will the factors shaping it. It can look, feel and be different for us all!

If you are a Business owner it also depends on your lifestyle, goals and aspirations and what you hope to achieve with your small Business, now and long term.

When you consider all these factors and influences, and which are the most important, you might see Success as providing benefits.

The 6 Benefits of Success

- Improve Cashflow

- Reduce risk

- Have clear direction

- Take action

- Develop a winning Team

- Having fun

Success looks like, feels like:

- achieving specific measurable goals and objectives,

- overall satisfaction, belief in self and Team

- being emotionally and financially stable, peace of mind

- doing what you love and enjoying your work everyday

- reward with profit for hard work

- making a difference, with personal effort, quality products and service.

Let's look more closely at the 6 Benefits of Business Success:

1. Improve cashflow:

A regular and smooth flow of money in and out of the Business necessary for daily operations, and costs including paying employee's, purchasing stock, and taxes. Positive cashflow indicate the Business liquidity.

There are 9 Ways to Help get your Cash flowing. Click on link.....https://blackburnaccounting.com.au/blog

2. Reduce Risk: Risk comes in different ways requiring different strategies to manage.

Read more...Calculate Co-Contributions

Check your eligibility for the co-contribution, it's a good way to boost your super. The amounts differ based on your income and personal super contributions.

If you are able to pay a little extra into your super before the end of the financial year 2024, the government may also make a contribution. Known as a co-contribution, you could receive up to a maximum of $500 contribution from the government into your super account if you are eligible.

Under the co-contribution scheme, the government provides a tax-free superannuation contribution of up to $500, matching 50% of a contributor’s own contributions.

|

Year |

Lower |

Upper |

|

2023-24 |

$43,445 |

$58,445 |

Superannuation What to Know

Superannuation has many facets, what to know, what is required, and what to do. To get the best outcomes speak with a professional about the strategies best suited to your situation.

If you are a Business owner Blackburn Accounting is available to provide professional advice. We offer a broad range of services including personal, Family Business Management, Cashflow Management, Superannuation and retirement planning, and Business Development.

Worth thinking about.

Consider splitting contributions with your spouse if:

- your family has one main income earner with a substantially higher balance or

- if there is an age difference where you can get funds into pension phase earlier or

- if you can improve your eligibility for concession cards or age pension by retaining funds in superannuation in the younger spouse’s name.

- remember any spouse contribution is counted towards your spouse's Non-Concession Contribution cap.

Want to know more, have questions!

Contact us, Blackburn Accounting, we are available and ready to help you with all your taxation and accounting needs.

Read more...

Boost your spouse's super and reduce your tax by making spouse contributions.

Tell me more!

How Does it work?

If you make an after-tax super contribution into your spouse’s super, you may be eligible for a tax offset of up to $540.

Consider this strategy if;

- Your spouse has an assessable income of less than $40,000 p.a.

What are the benefits?

- Grow your spouse's super

- Qualify for a tax offset of up to $540.

How is the spouse offset calculated?

- To qualify for the full offset of $540 in 2023/24 you need to contribute $3,000 or more into your spouse’s super. Your spouse must earn $37,000 p.a. or less.

- A lower tax offset may be available if you contribute less than $3,000 or your spouse earns more than $37,000 p.a. but less than $40,000 p.a.

Example Case study:

Bill and Mary are married and have two young children. Bill works full-time, earning $100,000 a year. Mary has reduced her workload and is now working two days a week and earns $32,000 a year.

The couple want to make sure Mary keeps growing her super while she is working part-time. Bill contributes $3,000 into Mary's super account. This entitles him to a tax offset of $540 which will reduce his income tax when he completes his 2023/24 tax return.

There are important things to consider when exploring the above and eligibility conditions apply. For more information check the ATO website

Need help, have questions and want answers and solutions?

Contact Blackburn Accounting we are your family Business Specialists offering a range of services including Superannuation and Retirement Planning.

Read more...

There is much to know about Superannuation and the following is provided to get you started.

Review your Concessional Contributions (CC) option and new rules:

The Government changed the contribution rates from 1 July 2020 to extend the ability to make contributions from age 65 up to age 67.

Maximise contributions up to CC cap of $27,500 per annum. Be careful not to exceed your limit if your Total Super Balance exceeds $500,000.

It's important to look after your Super!

Need help contact Blackburn Accounting we will answer your queries and sort out any problems.

Checklist for Employers – Superannuation obligations:

As an Employer part of your obligations is to pay Super Guarantee (SG).

Paying your Employees the right amount of Super,have you determined,

- which employees are eligible for super contributions?

- are any contractors eligible for super contributions?

- what payments are considered ordinary time earnings?

- should you apply for a certificate of coverage for employees you are sending overseas?

Have questions, need to know more, if you are a Business owner Blackburn Accounting is available to provide professional advice. We offer a broad range of services including personal, Family Business Management, Cashflow Management and Business Development.

The ATO website also provides information.

Read more...

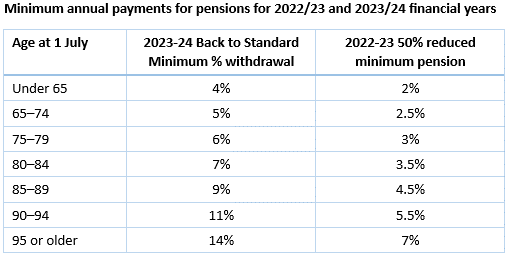

Review Options on Pension Payments

The Government extended the Temporary Reduction in Minimum Pensions as part of the COVID-19 response for FY2023. This program has now finished and the minimum pension payments have reverted back to the normal rates from 1 July 2023.

Superannuation has many facets. To get the best outcomes speak with a professional about the strategies best suited to your situation.

If you are a Business owner Blackburn Accounting is available to provide professional advice. We offer a broad range of services including personal, Family Business Management, Cashflow Management, Superannuation & Retirement planning, and Business Development.

Superannuation updates - Check the ATO website for more information.

Read more...Individual income tax rates and threshold changes

On 25 January 2024, the government announced proposed changes to Individual income tax rates and thresholds from 1 July 2024. These changes are not yet law.

From 1 July 2024, the proposed tax cuts will:

- reduce the 19 per cent tax rate to 16 per cent

- reduce the 32.5 per cent tax rate to 30 per cent

- increase the threshold above which the 37 per cent tax rate applies from $120,000 to $135,000

- increase the threshold above which the 45 per cent tax rate applies from $180,000 to $190,000.

For more information see Tax cuts to help with the cost of living | Treasury.gov.au

Read more...

The ATO is warning Business that pay contractors to provide certain services to lodge their taxable payments report (TPAR) for 2023.

The TPAR is used to report the payments made during the financial year to subcontractors or contractors. It is due on 28 August each year.

Be aware, from 22 March 2024, the ATO will apply penalties to those Businesses that haven’t lodged their TPAR from 2023 or previous years or have received three reminder letters about overdue TPAR.

If this is you, act now to avoid paying penalties.

Other – Outstanding Debts

From January 2024, the ATO has an external debt collection agency actioning tax cases they have referred.

This will apply to Taxpayers who haven’t responded to previous ATO contacts attempts or referral warning letters and are not engaged in debt repayment.

Don’t wait, contact the ATO or speak with our team at Blackburn Accounting asap.

Unsure of your responsibilities or what to do?

Need help!

Contact Blackburn Accounting we understand taxation matters,

or contact the ATO directly or check their website for further information.

Read more...

- ATO ramps up warnings on $50b in tax debts.

This warning from the new Tax Commissioner as the ATO chases $50 billion in outstanding debts, claiming increasing numbers of Australian small Businesses operators are falling behind on tax and superannuation obligations.

- At a recent small Business summit in Sydney the Commissioner said ‘it’s critical that all employers, big and small, keep on top of their obligations to their employers first and foremost, as well as their obligation to government in respect to GST, income tax and other taxes’.

- Previously, in November, the ATO warned Business to stop using unpaid tax and superannuation liabilities to prop up their cash flow, stressing its debt book was not a bank.

If these matters concern you, act now, heed the warnings!

Need help? contact Blackburn Accounting, we are experts in taxation matters.

- Tax Debts can affect your credit ratings

Disclosure of Business Tax Debts:

Be aware that in certain circumstance the ATO may disclose your debt information to credit reporting bureaus (also known as credit reporting agencies).

The ATO lists a number of criteria where they may report your Business tax debt. These are provided on the ATO website.

Note: It will not report your debt information to credit reporting bureaus (CRBs) if you are already engaged with them to manage your tax debts and may also decide not to report your tax debt information if you are experiencing exceptional circumstances.

You can find full details on the ATO website.

More from the ATO

Read more...Page 3 of 4

Your Accounting Partner

Your Accounting Partner Your Management Accounting Partner

Your Management Accounting Partner Your Expansion Engineer

Your Expansion Engineer Your Special Projects Partner

Your Special Projects Partner