Blog

The importance and power of a positive Business image can’t be understated or underestimated. This is how the world, and your customers, see you, and relate to you or not.

No matter if you are a corporation giant or family small Business corner store, it's important to show what you stand for and what you stand by. Your Business principles, core values, and goals. Your public image should be reflective of your Business.

Why it's important to build a strong brand image and identity

- A strong brand identity helps raise awareness about your services and products to customers and potential prospects.

- Creating a positive Business image is vital as public perception helps build a customer following.

- Your corporate identity, brand reputation, and how you are perceived by your customers, potential clients and community are critical to your success.

And in a time of economic challenges, and market uncertainty consumers are looking for Businesses they can trust, believe in and respect.

Customers want a feeling of stability and security during these turbulent times.

In this environment, your brand IMAGE is crucial to building loyalty, positive relationships, relationships that see customers coming through your door and returning for more! Your words and actions need to resonate with your customers and deliver what you promise. Personal and Business credibility is key to your success.

The alternative, as we often see, is damaged reputations due to various misadventures that have customers abandoning you.

How to Build a Strong Brand Image

Follow these steps:

Unlocking Success – How to Get the Best Results for Your Business

And don’t we all want that!

If you’re not achieving the results you want our BBB is a must attend!

- Learn How to build a Better Business, YOUR Business

- Learn Strategies, Techniques and Tips to make your Business the success it and you deserve!

Take action today for a successful future, your future!

Session dates – ‘Setting the Stage for Success’

Wednesday 1st November 2023

5.30pm to 7.30pm

Venue 931 Albany Hwy East Victoria Park

Tuesday 7th November 2023

5.30pm to 7.30pm

Venue 931 Albany Hwy East Victoria Park

Friday 17th November 2023

9.30am to 11.30am Perth WA

ONLINE Zoom

Here is what you will learn from the Session:

- Understand the crucial elements to Realise a Better Business

- Identify the key roadblocks that are holding you back

- Develop clear direction and how to do it

1 day Workshop – ‘Unlocking Success – How to Get the Best Results for Your Business’

Friday 8th December 2023

10am to 3pm

Venue 931 Albany Hwy East Victoria Park

Here is what you will learn from the Workshop:

- Crafting a solid Business Strategy that drives results

- Defining target audience and tailoring your offerings to meet their needs

- Implementing effective Marketing Strategies to reach and engage Customers

- Engage in activities and receive valuable related material

To book your place, Click our link

https://workshop.blackburnaccounting.com.au/

Unlocking Success – How to Get the Best Results for Your Business

And don’t we all want that!

If you’re not achieving the results you want our BBB is a must attend!

- Learn How to build a Better Business, YOUR Business

- Learn Strategies, Techniques and Tips to make your Business the success it and you deserve!

Take action today for a successful future, your future!

Session dates – ‘Setting the Stage for Success’

Wednesday 1st November 2023

5.30pm to 7.30pm

Venue 931 Albany Hwy East Victoria Park

Tuesday 7th November 2023

5.30pm to 7.30pm

Venue 931 Albany Hwy East Victoria Park

Friday 17th November 2023

9.30am to 11.30am Perth WA

ONLINE Zoom

Here is what you will learn from the Session:

- Understand the crucial elements to Realise a Better Business

- Identify the key roadblocks that are holding you back

- Develop clear direction and how to do it

1 day Workshop – ‘Unlocking Success – How to Get the Best Results for Your Business’

Friday 8th December 2023

10am to 3pm

Venue 931 Albany Hwy East Victoria Park

Here is what you will learn from the Workshop:

- Crafting a solid Business Strategy that drives results

- Defining target audience and tailoring your offerings to meet their needs

- Implementing effective Marketing Strategies to reach and engage Customers

- Engage in activities and receive valuable related material

To book your place, Click our link

https://workshop.blackburnaccounting.com.au/

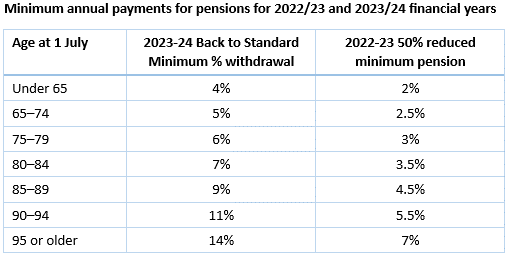

Review Options on Pension Payments

The Government extended the Temporary Reduction in Minimum Pensions as part of the COVID-19 response for FY2023. This program has now finished and the minimum pension payments have reverted back to the normal rates from 1 July 2023.

Superannuation has many facets. To get the best outcomes speak with a professional about the strategies best suited to your situation.

If you are a Business owner Blackburn Accounting is available to provide professional advice. We offer a broad range of services including personal, Family Business Management, Cashflow Management, Superannuation & Retirement planning, and Business Development.

Superannuation updates - Check the ATO website for more information.

Read on for our Useful Tips and 7 Point Business Insurance Checklist!

Are you one of the Small Businesses, facing the key challenges of balancing your budget and cashflow in our current economic climate?

Are the competing costs of running a Business, including labour and rising energy prices, along with cost-of-living pressures impacting consumer spending habits, leaving you financially strained. Have rising costs have become a significant concern.

If you have answered yes, keep reading.

For many Busineses, in this environment profits are being squeezed as inflation rises affecting fixed expenses costs such as rent and utilities along with the increased cost of goods and services. Everything is more expensive, including the cost of Insurance premiums.

And when looking for cost savings, reducing insurance coverage can be tempting. But consider carefully as the financial risk can be greater if a Business is not insured or adequately insured against unforeseen events. Imagine floods, fire, or theft damaging, disrupting or destroying your Business. The financial consequences can be consequential! How would you recover?

Insurance is the protection every Business needs. Build the premium into your budget.

7 Point Business Insurance Checklist:

- Review all your Insurance policies and check policy inclusions and exclusions.

- Has anything changed? Have you bought new equipment or vehicles, expanded your premises, signed a new lease, disposed of any assets or hired subcontractors?

- Business Performance – 5 Strategies - How to Get the BEST results in a changing landscape.

- 7 Essential Tips to Spring Clean Your Business and Boost Productivity

- Building Better Businesses - Workshop Sessions - Attention Small Business -

- DIY or Engage a Professional - Ask the critical Questions to Make the Best Decision for You!

Your Accounting Partner

Your Accounting Partner Your Management Accounting Partner

Your Management Accounting Partner Your Expansion Engineer

Your Expansion Engineer Your Special Projects Partner

Your Special Projects Partner